565.1. Purpose

To define policy and procedures for obtaining authorization and reimbursement for official travel by employees, Board members, and approved agents of the USHE Office of the Commissioner.

565.2. Approval

Utah Board of Higher Education approval: January 11, 2012. Revised: June 8, 2016; March 23, 2017; September 13, 2017.

565.3. Definitions

3.1. Official Travel: Official travel means authorized travel by an employee, Board member, or approved agent of the USHE Office of the Commissioner on USHE business. This does not include commuting from home to an employee’s regular place of employment.

3.2. Single-Day Travel: Official travel that requires the employee to be away from his or her normal place of employment, but not requiring an overnight stay.

3.3. Overnight Travel: Official travel that requires an overnight stay by the traveler.

3.4. In-lieu-of-airfare Rate: In-lieu-of-airfare rate means a rate of reimbursement for use of a personal vehicle for official travel, which is based upon the lowest practical airline fare (including applicable discounts, special fares, charters, etc.) available for airline flights which will reasonably accommodate the traveler’s schedule. The in-lieu-of-airfare rate will only be approved when the total cost is less than approved mileage rates.

3.5. Incidental Expenses: Incidental expenses include fees and tips for porters, hotel maids, baggage handlers, and other personal service employees. These expenses are to be covered by the traveler’s per diem.

565.4. Policy

4.1. Advanced Approval Requirement: All travel for which reimbursement is expected must be approved in advance by the USHE Commissioner or immediate supervisor after determining sufficient budget exists. No traveler may approve travel for himself or herself. Travel by the USHE Commissioner will be reviewed by the Assistant Commissioner for Planning, Finance, and Facilities.

4.2. Travel authorizations and requests for reimbursement shall be made using procedures and forms approved by the Assistant Commissioner for Planning, Finance, and Facilities.

4.3. Expense Payment and Reimbursement: USHE will pay reasonable costs associated with official travel including transportation, lodging, and per diem for meals and incidental expenses. UTAH SYSTEM OF HIGHER EDUCATION Number: 565 POLICIES Date: September 13, 2017 Page: 2 of 3 Subject: Travel Authorization and Reimbursement

4.3.1. Payment of Travel Expenses: Travelers are encouraged to utilize USHE credit cards and other procurement options to pay for approved travel expenses to avoid needing large reimbursements or creating undue financial burdens on travelers until reimbursements are available.

4.3.2. Private Vehicles: A traveler involved in official travel using a private vehicle will be reimbursed for mileage at the current IRS business mileage rate. When traveling within an area that allows the traveler to return to work or home the same day, reimbursable mileage must be supported by a mileage log using procedures and forms approved by the Assistant Commissioner of Planning, Finance and Facilities. USHE insurance does not provide coverage for damage to any private vehicle regardless of business or personal use. If more than one person travels in a private vehicle, mileage reimbursement is limited to one person.

4.3.3. USHE-Owned Vehicles: Use of USHE vehicles is encouraged for official travel when practical and available. USHE pays all expenses relative to its vehicles, therefore mileage reimbursement is not available to employees utilizing USHE vehicles.

4.3.4. Rental Vehicles: Vehicle rentals, when needed, should be booked using the State of Utah Travel Office following the guidelines provided by that office to ensure proper coverage under the State Division of Risk Management.

4.3.5. Air Travel: Travelers are encouraged to utilize the services of the Utah State Travel Office to arrange airfare. Documentation justifying other means of arranging travel must be provided otherwise.

4.3.6. Other Transportation Expenses: Reimbursement for other reasonably necessary transportation expenses such as for public transit or taxi cabs must be documented by receipts, tickets, or a written summary of expenses. Transportation expenses for personal reasons, even while on a business trip, shall not be reimbursed.

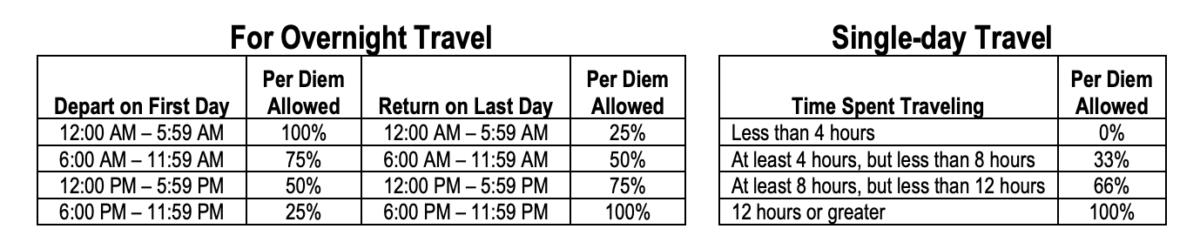

4.3.7. Per Diem: A traveler involved in official travel shall be reimbursed for meals and incidental expenses at the applicable M&IE rates found on the U.S. General Services Administration web site using the Per Diem Rates Look-up tool. Amounts for business meals paid by USHE while traveling should be deducted from that day’s per diem request. For partial-day per diem, use the following table:

4.3.8. Event Registrations: Pertinent brochures, agendas, meeting schedules, or some other document verifying the event are required for payment or reimbursement of registration fees associated with conferences or other events.

4.3.9. Lodging: Reasonable and necessary lodging expenses will be reimbursed or paid for stays at a hotel or motel. Overnight stays at locations other than a hotel or motel such as with friends or relatives, vacation rentals, personal camping facilities, etc. may be reimbursed at $25 per night.